Please contact or 1-800-MEDICARE to get information on all of your options. workers The federal government makes it legally required for organizations to provide their workers with medicare, social security contributions, workers’ compensation insurance, unemployment insurance, health insurance and family and medical leave. Any information we provide is limited to those plans we do offer in your area. 12 Benefits What are the legally required (mandated) benefits that must be provided to U.S.

We do not offer every plan available in your area. Enrollment in the plan depends on the plan's contract renewal with Medicare. Plans are insured or covered by a Medicare Advantage organization with a Medicare contract and/or a Medicare-approved Part D sponsor. government or the federal Medicare program. GoHealth and Medicare supplement insurance plans are not connected with or endorsed by the U.S.

Contact may be made by an insurance agent/producer or insurance company. The purpose of this site is the solicitation of insurance and informational purposes only. This website is operated by GoHealth, LLC., a licensed health insurance company. Benefits may vary by carrier and location. In short: you will first pay your deductible, then you will pay the percentage of coinsurance on your policy up to the out-of-pocket maximum, and then the plan. Not all plans offer all of these benefits. GoHealth helps Medicare beneficiaries enroll in Medicare Advantage plans.

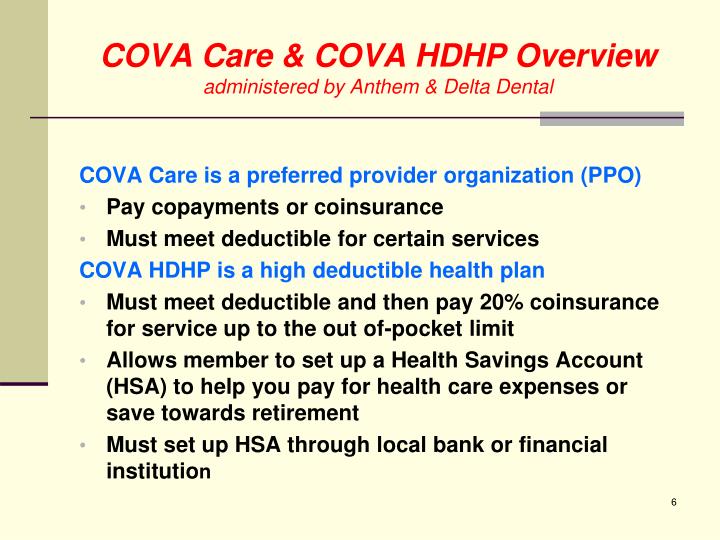

Coinsurance is a percentage of a total medical bill split between you and your insurer. Copays and coinsurance are two different costs shared with your insurance company.

0 kommentar(er)

0 kommentar(er)