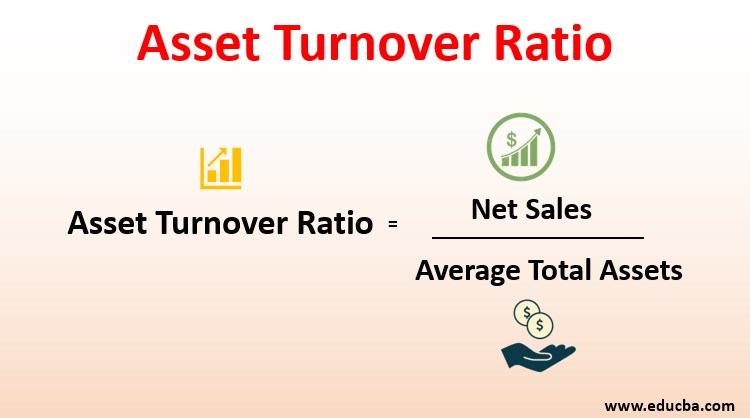

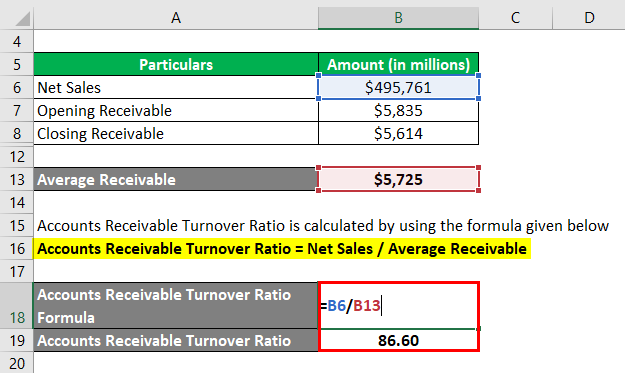

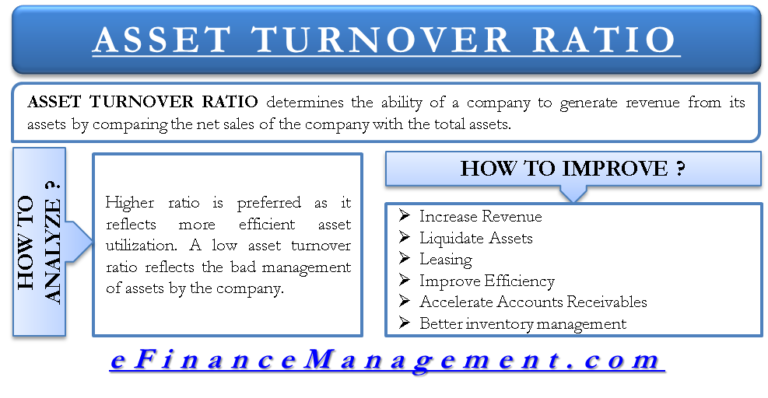

What Would Be Considered a Good Accounts Receivable Turnover Ratio? Consequently, this should give us a value of 5. Next, divide the net credit sales (£2,000,000) by the £400,000 in average accounts receivable to obtain the accounts receivable turnover ratio. Thus, the average accounts receivable figure would be adding up £300,000 and £500,000) followed by dividing the sum by two, thereby giving us £400,000. Its net credit sales during that accounting period amount to £2,000,000 in total. The beginning accounts receivable balance within a year is £300,000, and the ending balance is £500,000. To help illustrate the application of the accounts receivable turnover ratio, here is a real-world example for some additional context: Imagine a firm having to collect its accounts receivable from its customers year by year. On the other hand, net credit sale is defined as the payment to be collected from the customer on a later date, and it is calculated by subtracting the sales returns and sales allowances from the total credit sales: The accounts receivable turnover is calculated by adding up the beginning and ending accounts receivable figure, followed by dividing its sum by two to get the average accounts receivable for that period:Īfter that, the accounts receivable turnover ratio can be determined by dividing the net credit sales by the average accounts receivable that was previously calculated: Mathematically speaking, accounts receivable turnover is described as a financial ratio of net credit sales of a company within a specific accounting period divided by the number of times a company converts its average accounts receivable into cash within that identical period (usually on an annual basis). In addition, the accounts receivable turnover ratio is an essential component in financial modelling, whereby any assumptions surrounding its figure have a notable impact on the company’s forecasted balance sheet. On that note, accounts receivable turnover, also known as the debtor’s turnover ratio, is a metric often employed by accountants and business analysts to determine how efficient a company is at redeeming the credit that they have extended to its customers/clients. In the majority of cases, the most effective way for businesses to avoid losses from bad debts is to ensure the quick turnover of their accounts receivable.

To help corporations achieve these objectives, Kolleno is a smart credit control platform that can help companies increase their accounts receivable turnover ratios by automating their cash application procedures. This, in turn, is a very crucial factor for companies when they are applying for bank loans, reinvesting capital into their business operations, or attempting to attract third-party investors. As a result, expenses associated with accounts receivable will be lowered, thereby increasing the balance sheet’s health. In essence, when a business is able to manage its accounts receivables effectively, its cash flow becomes increasingly stable and predictable. Such strategies may include executing an effective debt collection procedure or conducting proper credit checks on the customers before agreeing to serve them. On the other hand, a low accounts receivable turnover ratio suggests the management team’s incompetency in collecting its customer’s payments punctually.ĭeveloping solid cash flow management strategies is vital for all companies if they seek to maintain a healthy cash position. The accounts receivable turnover ratio is typically expressed as the net credit sales divided by the average accounts receivable balance during the specified period.Ĭompanies generally aim for a high accounts receivable turnover ratio as it indicates an efficient debt collection procedure employed by the firm. Such durations are often measured on a monthly, quarterly, or annual basis.Ĭalculating the company’s accounts receivable turnover is a critical financial metric to assess how soon a business can recover the money it is owed by its customers/clients after having delivered its products and/or services upfront. The accounts receivable turnover measures the number of times a business is able to convert its outstanding accounts receivables to cash within a certain period.

0 kommentar(er)

0 kommentar(er)